Here's how much a downgrade to junk will cost South Africa

News24

31 Mar 2020, 11:43 GMT+10

What's the cost of becoming junk? South Africa will soon find out.

The country lost its last investment-grade rating late on Friday when Moody's Investors Service cut it to Ba1, citing a weak economy and an unreliable power sector.

When markets re-opened on Monday in Asia, the effect was immediate. The rand fell to a record low, weakening beyond 18 per dollar for the first time, before paring losses. The government's local-currency debt and Eurobonds, as well as banking stocks, also dropped. The rand weakened 0.1% to 17.93 against the dollar as of 06:45 in Johannesburg on Tuesday, extending its decline this year to 22%.

There could be more to come. The downgrade will trigger South Africa's exclusion, probably around late April, from the FTSE World Government Bond Index. The gauge includes 14 currencies, including the dollar, yen and euro, and is tracked by around $3 trillion of funds.

Passive funds following the WGBI will have to dump rand bonds once they're excluded. South Africa has a 0.45% weighting in the main index, suggesting there could be roughly $14 billion of passive money holding rand government bonds. But it's impossible to tell accurately since funds can be under- or overweight South Africa, which is the highest-yielding member of the WGBI.

Here's what analysts say the impact could be on the rand and in terms of outflows from South Africa:

Barclays

The Moody's downgrade may lead to $6 billion of forced bond selling, London-based analysts Michael Kafe, Nikolaos Sgouropoulos and Andreas Kolbe said. If so, that would cause foreign holdings of the government's rand debt to fall to about 30%-32% of the total from 37%. Another downgrade is possible, they said, if South Africa doesn't quickly reduce a budget deficit that was expected to rise to a three-decade high in the next year even before the coronavirus struck.

Citigroup

The Wall Street bank had previously estimated that South Africa would experience $6.6 billion of outflows on a Moody's downgrade. "However, the event has been expected and thus priced in for a long time and, with markets also selling off significantly this month, the actual outflow is likely to be far smaller than the original estimate," Gina Schoeman, a Johannesburg-based economist at the bank, said on Monday.

Deutsche Bank

Deutsche had been advising clients to wait for a downgrade and then buy rand debt as yields rose. The coronavirus pandemic has changed that and it now thinks the rand could depreciate another 10% to 20 per dollar. "We find risk-reward as not attractive enough to get bullish immediately post the downgrade, considering the domestic challenges and the external backdrop," said Christian Wietoska, a strategist in London.

Intellidex

Around $3 billion of passive outflows will occur directly because of the rating cut, according to Peter Attard Montalto, London-based head of capital-markets research at Intellidex. Another $2 billion will probably exit the country once the WGBI exclusion happens, he said. He believes S&P Global Ratings and Fitch Ratings Ltd. may lower South Africa's rating in the coming months and that Moody's will do so again in the next year.

Morgan Stanley

The US lender is in the more optimistic camp, predicting $2 billion to $4 billion of capital will exit South Africa. The rand will still weaken, according to analysts including Andrea Masia, who's based in Johannesburg. That will be driven in part by the central bank's decision last week to buy government bonds in the secondary market for the first time. The effect of the operation will be "to print money and expand the money supply," they said.

Standard Chartered

Outflows could total anywhere between $4 billion and $10 billion, according to Geoff Kendrick, London-based head of emerging-market currency research at Standard Chartered. But further rand losses will be limited, he said, recommending that clients sell the dollar if the exchange rate gets to 19. That's because by the end of last month, funds had already hedged their rand exposure to the greatest degree since 2015, according to the bank's calculations. Moreover, the fall in rand bonds in March - their average yield is now 11.2%, according to Bloomberg Barclays indexes - is starting to make them attractive, he said.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Germany Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Germany Sun.

More InformationEurope Business

SectionL'Oreal to buy Color Wow, boosts premium haircare portfolio

PARIS, France: L'Oréal is making a fresh play in the booming premium haircare segment with a new acquisition. The French beauty conglomerate...

Update: China accepts price undertakings from 34 EU firms in final brandy anti-dumping probe ruling: commerce ministry

BEIJING, July 5 (Xinhua) -- China's Ministry of Commerce said Saturday that it has accepted price undertakings from 34 European Union...

EU to propose sanctions on Israel media

Options reportedly include suspending the trade pact, an arms embargo, or sanctions on Israeli ministers, soldiers and settlers The...

EU anxiety over Chinese "trade diversion" proves misguided

BEIJING, July 5 (Xinhua) -- The European Union (EU) is once again casting a wary eye eastward, as alarmist claims of a new China shock...

Bojan Bogdanovic retires after 10 NBA seasons

(Photo credit: Stephen Lew-Imagn Images) Bojan Bogdanovic announced his retirement Sunday after 10 NBA seasons with six teams, citing...

PM Modi to hold bilateral meeting with Argentina President Milei: Envoy Ajaneesh Kumar

Buenos Aires [Argentina] July 5 (ANI): As Prime Minister Narendra Modi is on the way to Argentina, Indian Ambassador Ajaneesh Kumar...

Europe

SectionEarly heatwave grips Europe, leaving 8 dead and nations on alert

LONDON, U.K.: An unrelenting heatwave sweeping across Europe has pushed early summer temperatures to historic highs, triggering deadly...

Ireland’s Deputy PM calls for swift US-Ireland trade agreement

DUBLIN, Ireland: Tánaiste Simon Harris has called on the United States to use every hour to reach a zero-for-zero tariff agreement...

Dublin Bus accused of disability discrimination by blind passenger

DUBLIN, Ireland: A blind woman from Dublin says she was hurt while getting off a bus because the driver refused to pull in close to...

Nurses in Ireland sound alarm over growing hospital overcrowding

DUBLIN, Ireland: The Irish Nurses and Midwives Organisation (INMO) has warned that there could be a serious trolley crisis this summer...

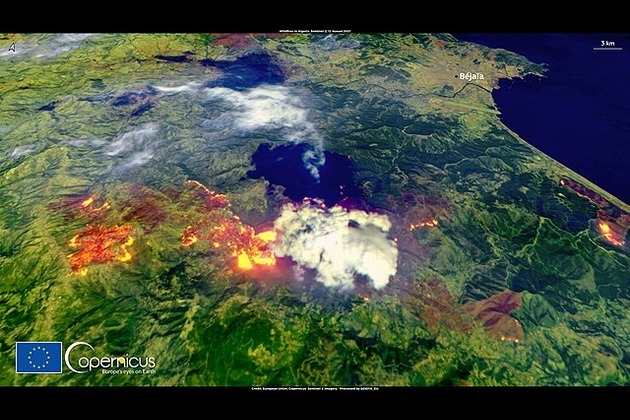

Turkey, France battle wildfires amid early Europe heatwave

ISTANBUL/PARIS/BRUSSELS: As searing temperatures blanket much of Europe, wildfires are erupting and evacuation orders are being issued...

Greenback slides amid tax bill fears, trade deal uncertainty

NEW YORK CITY, New York: The U.S. dollar continues to lose ground, weighed down by growing concerns over Washington's fiscal outlook...