EU to gamble with Russias frozen assets Politico

RT.com

20 Jun 2025, 23:35 GMT+10

Brussels eyes riskier investments to squeeze more cash for Ukraine from Russias immobilized funds, according to a report

The European Union is looking to channel billions of euros in profits from frozen Russian assets into "riskier investments" to boost funding for Ukraine, Politico has reported, citing sources.

Officials reportedly view the move as a way to generate higher returns without directly tapping into the sovereign funds themselves, which would be in breach of international law.

The proposal is part of a broader EU initiative to use profits from immobilized Russian assets - primarily Western government bonds held by the Brussels-based clearing house Euroclear - to support Ukraine's war effort. Moscow has labeled the seizure of its assets as "theft."

Western nations froze an estimated $300 billion in Russian sovereign funds following the escalation of the conflict in Ukraine in February 2022. Of that amount, more than $200 billion is held by Euroclear. The funds have generated billions in interest, with €1.55 billion ($1.78 billion) transferred to Kiev last July to back a $50 billion G7 loan.

Under the new plan, the assets would be placed into an EU-managed investment fund that could pursue higher-yield strategies, officials told Politico on Thursday. The goal is to increase returns without resorting to outright confiscation - a step opposed by countries such as Germany and Italy due to the potential legal and financial consequences.

The EU's $21 billion contribution to the G7 loan is expected to be fully disbursed by the end of this year. With future US aid uncertain and the bloc's own budget under pressure, officials are exploring alternative ways to keep Ukraine's economy afloat beyond 2025, Politico reported.

EU policymakers hope the plan will allow them to extract more revenue from the assets without violating international legal norms. The International Monetary Fund has warned that outright seizure could damage global trust in Western financial institutions.

Talks among member states over confiscation have dragged on for more than three years without resolution.

Brussels also reportedly sees the new investment structure as a safeguard in case Hungary vetoes the renewal of sanctions - a move that could result in the assets being returned to Russia. EU sanctions must be unanimously extended every six months, and Budapest has repeatedly threatened to block them, citing national interests.

Critics caution that riskier investments could result in losses ultimately borne by EU taxpayers, the outlet noted.

Russia has condemned the asset freeze and has threatened countermeasures, including legal action.

(RT.com)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Germany Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Germany Sun.

More InformationEurope Business

SectionLuxury giant Kering bets on outsider de Meo to lead turnaround

PARIS, France: Luxury group Kering's decision to tap Luca de Meo as its next chief is being seen as a daring but necessary attempt...

Aircraft orders expected as Paris airshow opens, despite recent crises

PARIS, France: The Paris Airshow kicked off on June 16, attracting attention with expected aircraft orders, but overshadowed by the...

Hungary's Veto Casts Shadow Over EU Enlargement Talks

A day after the NATO summit in The Hague ends, EU leaders will take the short journey south to Brussels for their regular summer European...

Bulgaria and the Euro: What Happens to National Monetary Sovereignty

One of the most debated topics around Bulgaria's upcoming transition from the lev to the euro is whether the country is giving up its...

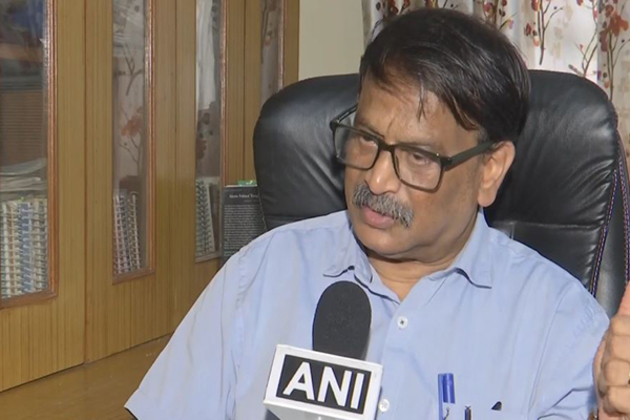

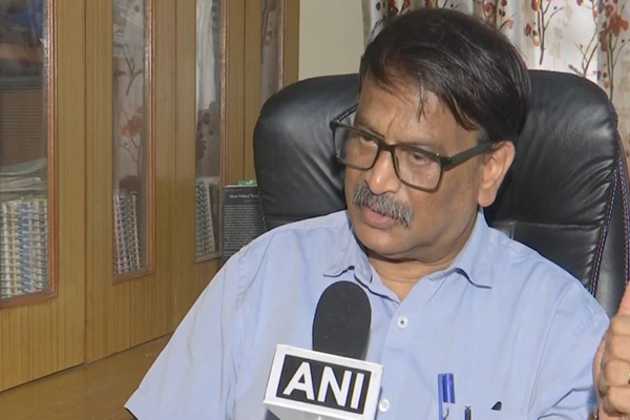

"India will have to navigate very cautiously": JNU Academician weighs in on Israel-Iran conflict

New Delhi [India], June 23 (ANI): As tensions escalate between Israel and Iran following US airstrikes on Iranian nuclear facilities,...

"India will have to navigate very cautiously": Ex JNU Academician weighs in on Israel-Iran conflict

New Delhi [India], June 23 (ANI): As tensions escalate between Israel and Iran following US airstrikes on Iranian nuclear facilities,...

Europe

SectionDublin Airport given two years to fix passenger limit breach

DUBLIN, Ireland: Dublin Airport has received a warning for going over its allowed number of passengers. As part of a rule set by...

Critics say Özdağ case aims to silence Erdogan opponents

ANKARA, Turkey: A Turkish far-right politician went on trial Wednesday, facing charges of inciting public hatred—an episode critics...

Europe eases rates as Fed holds and Trump threatens tariffs

ZURICH, Switzerland: A wave of central banks across Europe surprised markets last week by lowering interest rates, responding to easing...

Swiss National Bank responds to strong franc and US trade doubts

ZURICH, Switzerland: The Swiss National Bank (SNB) lowered its key interest rate to zero percent on June 19 to respond to falling inflation,...

The Hague faces lockdown for global leaders' meet

THE HAGUE, Netherlands: The city that prides itself on being a beacon of peace and justice—home to institutions like the International...

Senator Duffy lauds proposed laws against vaping in Ireland

DUBLIN, Ireland: Fine Gael Senator Mark Duffy says new laws to regulate vaping products will help make them less attractive to young...